Featured announcement

Xpansiv Announces Acquisition of Evident

The acquisition creates a global clean energy registry leader combining Evident’s and Xpansiv’s renewable energy certificate (REC) registries with over 300 GW of capacity.

Announcements

Featured News, Xpansiv

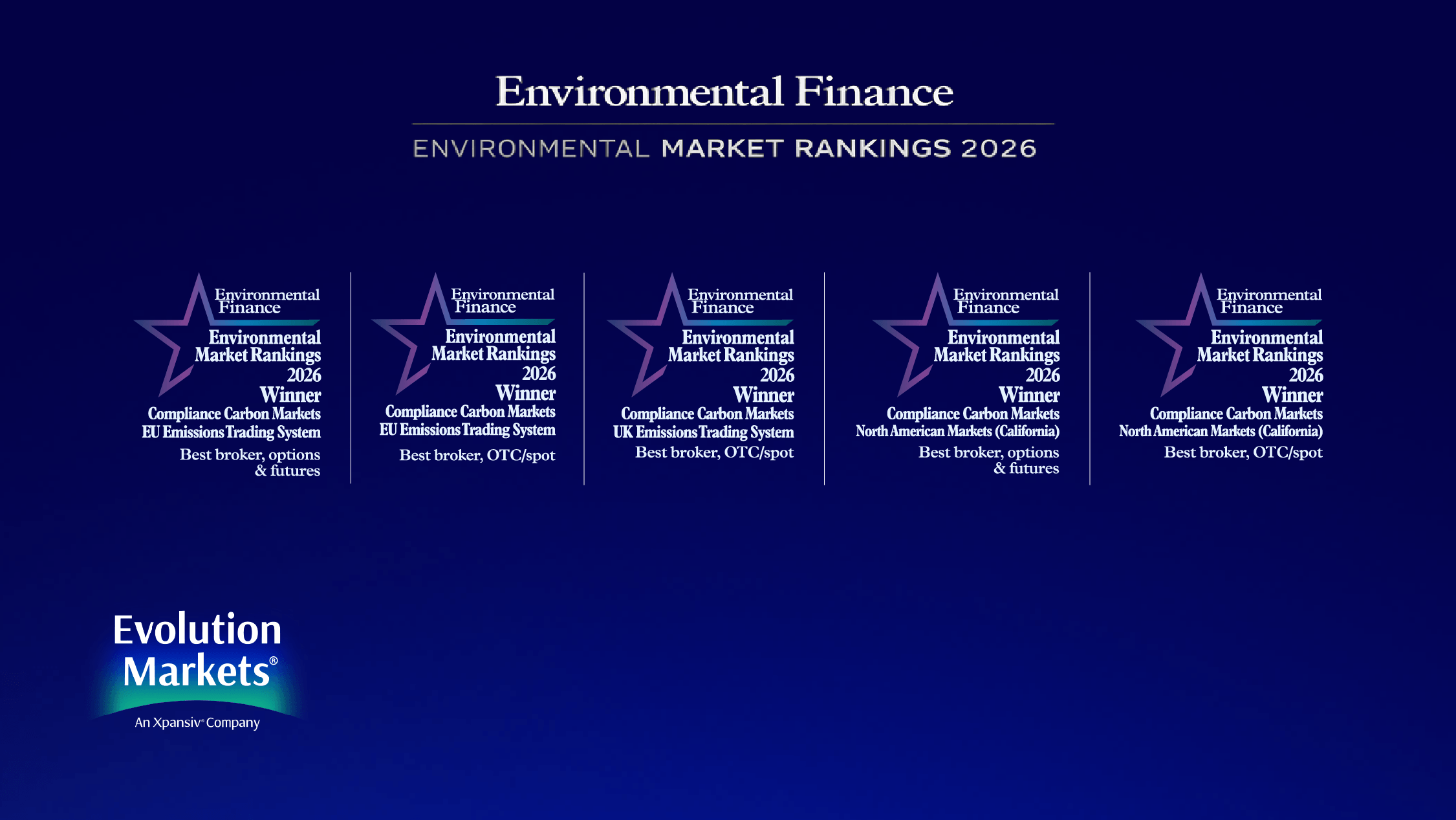

Evolution Markets Named Best Broker Across EU, UK, and North American Carbon Markets in 2026 Environmental Finance Rankings

Featured News, Xpansiv

MEX and Xpansiv Enter Strategic Partnership to Advance Global Environmental Commodities Market Connectivity

Featured News, Xpansiv

Xpansiv Named a Top Workplace for Second Consecutive Year

Featured News, Xpansiv

Xpansiv Marks Milestones in Energy Transition Infrastructure Platform

CBL, Featured News

Nuclear-based EFECs Trade 675,000 MWh on Xpansiv CBL in First Week

Featured News, Xpansiv

Quidos Selects Xpansiv to Launch the First Global Digital Carbon Credit Registry for the Built Environment

EMA, Featured News

GreenBlue Integrates Recycled Materials Registry with Xpansiv Connect™ to Expand Global Reach

EMA, Featured News, Xpansiv

Xpansiv Announces Acquisition of Evident to Strengthen Global Renewable Energy Markets

CBL, Featured News, Xpansiv, XSignals

Constellation and Xpansiv to Launch Clean Energy-Based Certificate Trading

Press

Power surge: The impact of energy addition on environmental commodity markets

Xpansiv CEO sees AI-driven power supercycle fueling global growth in REC markets

Nuclear energy certificates gain momentum in the US as hourly tracking is debated

Xpansiv announces acquisition of Evident Group

Xpansiv acquires Evident to build global REC platform

Constellation is getting nuclear into the clean energy credits game

NH Investment & Securities signs MOU with Xpansiv to expand Korea carbon credit access

KRX Signs MOU with Xpansiv to Strengthen Carbon Market Business

Interview: Xpansiv CEO John Melby About the Technology Behind Environmental Credits Trading