The newly augmented broker indicative data series unlocks new ways to analyze, model, and visualize market trends

Xpansiv has introduced major enhancements to the Evolution Markets broker indicative Forward Price datasets, enhancing its utility expanding the way market participants can analyze and apply Forward Curve data.

With these upgrades, users can now filter across pricing data by relative period rather than an static date on a calendar.

In addition, Xpansiv now provides implied monthly contracts across eight commodity markets, reducing the manual workload for analysts who need clean, structured data for quantitative models or simply want to visualize normalized market trends.

See our Fact Sheet for a full breakdown of the enhancements, including a data dictionary and a guide to upgraded attributes.

Markets covered:

| Commodity Market | # of Products | History Begins |

| US RECs | 47 | 2008 |

| US Power | 42 | 2018 |

| US Emissions | 7 | 2002 |

| Carbon | 10 | 2008 |

| Natural Gas Basis | 65 | 2021 |

| Natural Gas Index | 41 | 2021 |

| Coal | 13 | 2000 |

| Nuclear | 9 | 2006 |

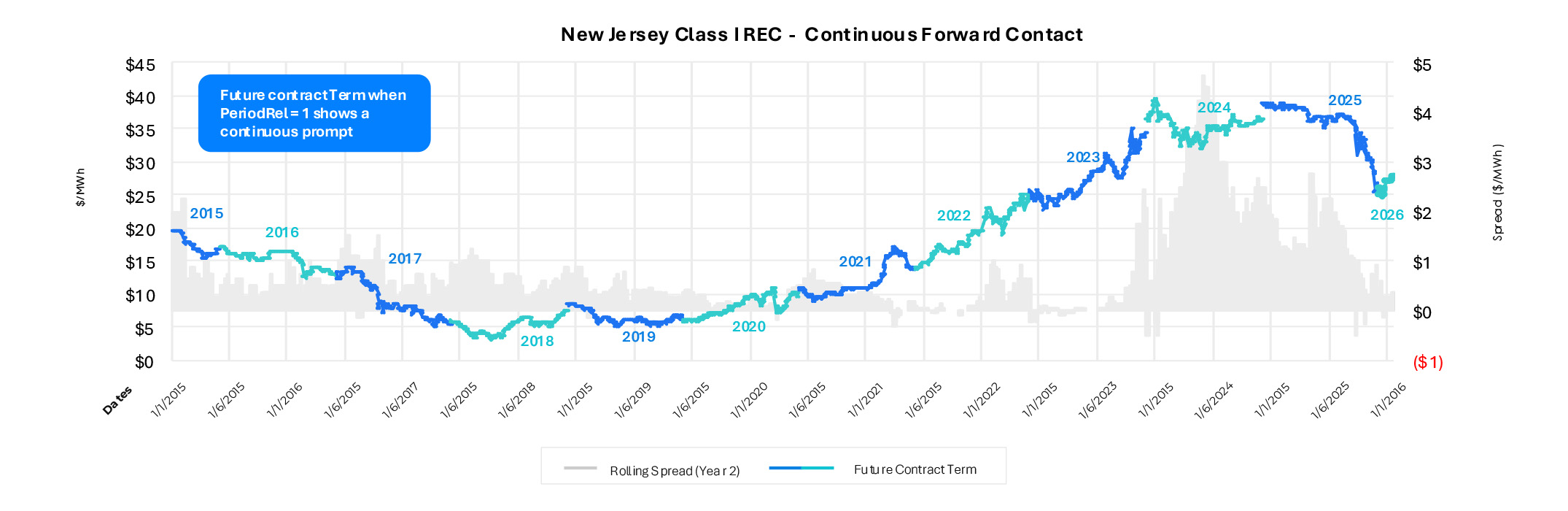

Tackling the Forward Curve Challenge

One of the biggest hurdles for analysts using forward pricing data is the inconsistent and fragmented structure of contract dates. Delivery terms often span monthly, quarterly, seasonal, or calendar strips, making trend analytics and model integration cumbersome. Take the example of US RECs. While the generation vintage may be tied to a calendar year, the trading window for compliance may run well into the following year. To find the prompt price for a New Jersey Class | REC Vintage 2026, users need both a calendar adjustment and a data model to align the contract with its true delivery period. (June 1, 2025 – May 31, 2026).

Xpansiv’s new data Continuous Forward data simplifies this process by enabling data filtering by relative periods using a PeriodRel attribute as shown below

Product = New Jersey Class I

PeriodRel = 1

With this attribute, users can instantly plot prompt contract values across history, unlocking fast, reliable trend analysis

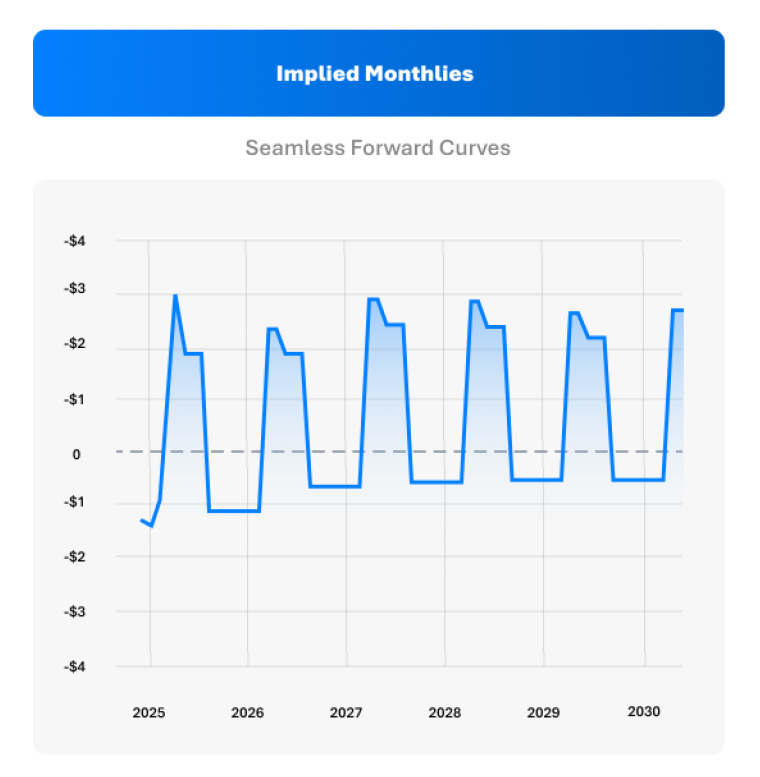

Implied Monthlies:

Xpansiv has further enhanced our OTC data products by introducing implied monthly prices that fill in gaps where contract term intervals are longer than a monthly cadence. For example, contracts in Natural Gas markets are often traded on quarterly or seasonal delivery terms, making it difficult for data users to easily build a forward curve. This is where Xpansiv’s new implied monthly prices greatly simplify curve building. By extracting data from terms like 2026-Q4, 2026-Winter, or the 2026 Calendar Year, users can view a seamless monthly price series across the entire forward curve.

This approach streamlines:

- Integration into quantitative models and ETRMs

- Building visualizations and dashboards

- Performing precise comparisons across future delivery months

Standardized, Accessible, and Scalable through Modern Data Infrastructure

Xpansiv’s continuous and implied monthly forward contracts are standardized across the eight commodity markets in the table above. Clients can consume data from a single point of access- web platform, API, SFTP, or email reports.

Contact data@xpansiv.com to learn more or request a demo.