LOW CARBON FUELS

A New Way to Transact LCFS Credits

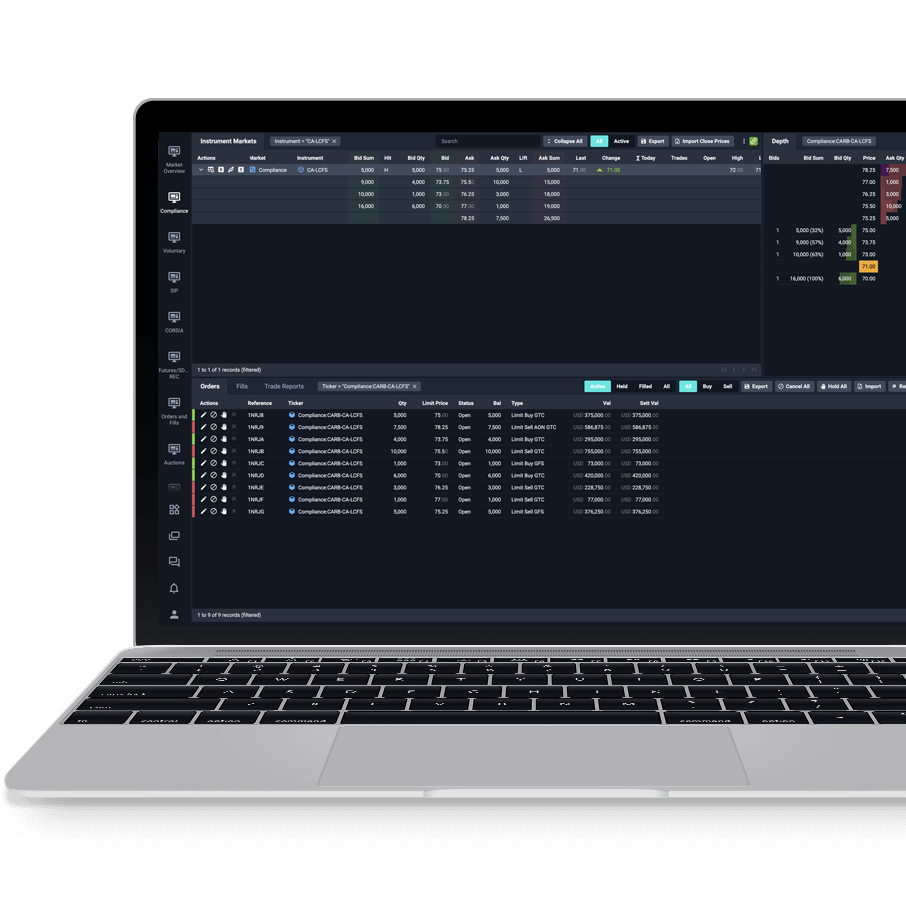

CBL’s first-of-its-kind LCFS contract enables companies to trade in a transparent exchange environment with immediate access to liquidity and live pricing provided by hundreds of active environmental market participants. Users gain access to a single screen hosting a diverse network of credit-worthy market participants, helping unify a market historically driven by fragmented, over-the-counter transactions.

As the market continues to mature, CBL’s LCFS spot contract will provide transparent, intraday price signals and establish a reliable benchmark. Participants can use this pricing data in trading and risk models, to mark open positions to market, and as a reference price in OTC derivatives.

GET STARTED

Harness the power of Xpansiv Auctions or Request for Quotes (RFQs) to reach hundreds of counterparties with buy or sell interest. Participants can choose from a range of auction and RFQ types to leverage Xpansiv’s infrastructure for competitive, tailored LCFS bids and offers.

Please contact us to find out more about Xpansiv’s platform and services. We look forward to speaking with you!

Contact Us