International Organization of Securities Commissions (IOSCO)

Calle Oquendo 12

28006 Madrid

Spain

Comment on IOSCO VCM Report

Xpansiv Ltd. (“Xpansiv”) welcomes this opportunity to provide responsive comments to the International Organization of Securities Commissions (“IOSCO”) Voluntary Carbon Markets Discussion Paper (“VCM Paper”).[1] Xpansiv supports an open and ongoing dialogue among market participants and global regulators regarding efforts to help scale a trusted, transparent, and high integrity voluntary carbon market (“VCM”).

Xpansiv’s role as the leading market infrastructure provider for environmental registries and spot commodity trading gives it a unique perspective to comment on IOSCO’s consultation. We modeled our platform on the rules-based market design and infrastructure of more fully developed commodity markets (e.g., energy, agricultural commodities). We have been fortunate to have participated in the growth and maturation of the VCM by helping build a transparent, centralized architecture that enables predictable transactions, T+0 settlement, market-driven price discovery, data analytics, and environmental claims management systems for all stakeholders.

In 2020, Xpansiv introduced standardized spot trading contracts, underpinning the world’s first—and premier—set of VCM futures contracts which began trading on a regulated derivatives exchange in 2021.[2] Standard spot and futures contracts form the basis for a more sophisticated VCM, one built on market data and price discovery benchmarks. We hope these and other similar experiences enable Xpansiv to make useful contributions to the VCM dialogue and recommend that IOSCO continue to use its expertise and convening power to build best practices for corporate carbon accounting and disclosure.

INTRODUCTION

Xpansiv is a family of companies[3] that together operate the prevailing market infrastructure that underpins the global VCM and several other environmental markets. As further identified in Exhibit 1, we maintain the world’s leading spot market exchange for voluntary carbon offsets (“offsets”) as well as the underlying asset registry account systems for an array of environmental commodities. Our end-to-end platform provides seamless account access, enabling participants the ability to buy and sell offsets, take physical delivery of those assets same day (T+0 settlement), manage their multi-asset portfolios across multiple environmental registries, and optimize their climate action goals and strategic pricing objectives using robust, exchange transaction data.

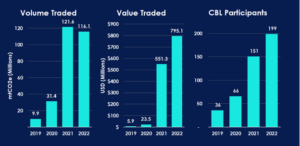

Exhibit 1: Volume traded, notional value traded, and the number of trading firms on Xpansiv’s spot market, CBL, have all grown significantly in recent years.

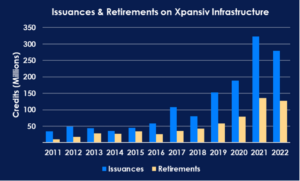

As illustrated in Exhibit 2, our APX registry infrastructure is utilized by the largest global standards bodies (e.g., Verra, Climate Action Reserve, and American Carbon Registry)[4] and our spot market has nearly 200 trading participants, spanning leading corporate sustainability teams, project developers, and financial intermediaries. We also maintain a network of partnerships with all major environmental standards bodies and registries, non-governmental organizations, third-party certifiers, and trade organizations across multiple industrial sectors.

Exhibit 2: Issuances and retirements from American Carbon Registry, ART TREES, Climate Action Reserve, and Verra which all operate using Xpansiv registry technology.

Based on its market position and experience, Xpansiv respectfully offers the following general comments on IOSCO’s VCM Paper.

GENERAL COMMENTS

A. Offset Credits Should Continue to be Treated as Physically-Settled Environmental Commodities

The legal nature of voluntary offsets is settled law across the vast majority of jurisdictions around the world. Offsets validly issued into a VCM registry account are generally treated by legal practitioners as nonfinancial intangible commodities that physically deliver, upon transfer, a defined set of intangible property rights to verified environmental claims.

In the United States, for example, the Commodity Exchange Act of 1936, as amended, and regulations promulgated thereunder by the U.S. Commodity Futures Trading Commission (“CFTC”), broadly define the term “commodity” to encompass virtually all goods, services, and interests.[5] The CFTC generally recognizes “environmental commodities,” including voluntary carbon offsets, as commodities akin to wheat and soybeans rather than “commodity interests,” such as futures or swaps.[6]

Wheat and soybeans, commodities that can be physically delivered and consumed, are considered nonfinancial commodities.[7] Environmental commodities are intangible commodities that can also be physically delivered and consumed and, therefore, qualify as nonfinancial commodities.[8] Voluntary offsets are physically delivered through title transfer from one registry account to another and are consumed by end-users in commerce to satisfy the terms of voluntary or mandatory environmental programs.[9]

Sales of commodities on a “spot” or “cash” basis where the seller delivers the purchased commodity to the purchaser within a timeframe typical for sales of such a commodity are generally outside the scope of financial regulatory jurisdiction. Similarly, sales of commodities where delivery of the commodity is deferred for reasons of commercial convenience or necessity, known as “forwards,” are generally outside of financial regulatory jurisdiction.[10]

B. The Design and Development of Environmental Market Infrastructure are Modelled on Recognized and Familiar Commodity Markets

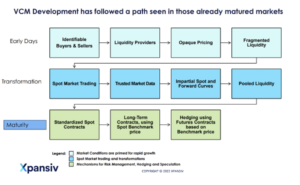

The evolution and development of VCM infrastructure have followed a path seen in nearly all mature commodity markets. As described in Exhibit 3 below, the VCM began almost 25 years ago as a mechanism to meet corporate demand for offsets as tools for managing sustainability and carbon neutrality commitments. A number of voluntary carbon standards bodies emerged to devise and govern a series of carbon offset methodologies to enable project developers to register, validate, and verify the achievement of emission reductions entitled to offset credit issuance.

Exhibit 3: Carbon markets have progressed through a common evolution to become mature commodity markets.

From those earliest days, the VCM has matured in an accelerating manner. Until about 2019, the VCM was characterized as a market that had disjointed buying and selling activity facilitated by brokers and other intermediaries, which required market participants to find each other and negotiate pricing for offsets based on often opaque, fragmented pricing. As corporate interest in the markets increased, so too did the search for technological solutions that would allow buyers and sellers to conduct more efficient price discovery based on a variety of credit characteristics, like project regions, methodologies, vintages, and more. Xpansiv’s CBL electronic spot market was one of the earliest platforms to enable market participants to conduct price discovery in such a manner.

C. The Emergence of Standard Market Contracts and Advanced Market Data are Driving Maturity in the VCM Through Liquidity, Price Discovery, and Risk Management

The VCM today has mechanisms available for standardized spot market trading, the ability to use futures markets for hedging and risk management purposes, and—with the emergence of benchmarks—pricing that is utilized as a price reference for over-the-counter trading as well.

In October 2020, Xpansiv launched the first standardized spot trading contract in the modern VCM: the Global Emissions Offset (“GEO”). The GEO was developed using defined qualifying criteria set forth by the International Civil Aviation Organization for purposes of the Carbon Offsetting and Reduction Scheme for International Aviation. Market participants could deliver any credit that met the criteria outlined in the contract specifications, and buyers were guaranteed that delivered credits would meet the criteria. This presented the first spot trading contract that the market could use to develop a standard, transparent, high-integrity price benchmark for multiple classes of offsets. The market took up the GEO, and then later further spot contracts, including the Nature-based GEO (“N-GEO”), Core GEO (“C-GEO”), and most recently, the Sustainable Development GEO (“SD-GEO”).

Xpansiv developed and published the Standard Instruments Program, which sets forth governance for how the standardized contracts are structured based on carbon project type and a set of eligibility criteria that reflects different preferences of the existing VCM.[11] These standardized spot contracts:

- Enable market participants to purchase and take delivery of offsets that convey a threshold set of high-quality environmental claims;

- Price the characteristics that compose the qualitative thresholds underlying a standard spot contract;

- Price the deviations, or basis, between project-specific offsets and the related standard contract;

- Price the deviations between different standard contracts;

- allow for the design and launch of derivatives contracts that provide all the benefits they do for other markets for forward risk management;

- Provide liquidity and structure that allows traditional market intermediaries to participate; and

- Utilize electronic trading infrastructure to create robust sets of trusted market data.

All these benefits have resulted in our family of standardized GEO contracts becoming the basis for benchmark pricing in the VCM. CME Group(“CME”) has listed futures contracts on its NYMEX Designated Contract Market that physically settle using the spot GEO contracts for the monthly settlement price at expiration. Therefore, in 2023, the VCM has a commodity complex of individual projects that can be traded bilaterally, but whose pricing can be referenced to the various GEO-complex contracts.[12] As market stakeholder initiatives continue to drive attribute taxonomies for “high quality” offsets, each successive set of criteria can become the basis of the next set of standard GEO contracts.

Xpansiv’s standardized spot contracts pool liquidity on a centralized, electronic spot market where, previously, only fragmented, idiosyncratic liquidity for specific projects was available directly from project developers and broker networks. These instruments enable the market to efficiently price the specific asset-level qualities outlined in the qualification criteria for each contract. The emerging market data generated via standardized contracts then enables more mature and sophisticated price discovery—in both premium and discount directions—for VCM projects and assets from the “baseline criteria” of each contract. The introduction of futures derivatives structured on top of Xpansiv’s spot market contract complex further enables enhanced liquidity and price discovery by allowing participants to shift price risk along a forward curve. The CME/NYMEX VCM futures complex also provides a venue for market participants preferring to transact on a regulated contract market. It was on this basis that Xpansiv partnered with S&P Global/Platts, an IOSCO-recognized Price Reporting Agency, to establish daily price assessments of spot and forward markets.[13]

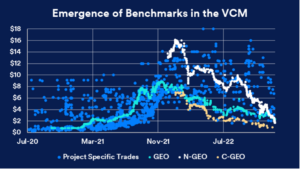

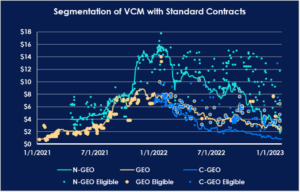

Exhibits 4-6 (from top left to bottom right): “Standardized Contracts on CBL” displays the growth of the absolute volume traded through contracts, as well as the total portion of carbon traded on CBL that transacts through standardized contracts. “Emergence of Benchmarks in the VCM” exhibits how standardized contracts have brought clear price signals to the VCM. “CME Futures Open Interest” shows the growth of open positions across the three VCM futures contracts listed on CME Group’s NYMEX DCM.

The arrival of a fully realized commodity market structure in the VCM has enabled a transformation in trading based on trusted, verifiable market data. Market participants rely heavily on this market structure to manage price risk; they are now able to implement increasingly sophisticated trading and risk management strategies, as more and more robust market pricing data and tools become available.

As Exhibit 7 illustrates, these important developments have bolstered liquidity and price transparency in the market. Standardized contracts now provide clear price signals, resulting in more efficient price discovery for both buyers and sellers.

Exhibit 7: Daily assessed closing prices for standardized contracts, represented by lines, against transactions of credits that qualify for the contracts (dots); the structure reveals how standardized contracts provide price signals that the market can utilize to price qualifying credits at a basis premium to the baseline benchmark.

D. IOSCO Can Play a Valuable Role in Developing Collaborative Guidance on Carbon Accounting and Climate Risk Disclosure

Creating greater certainty with respect to how market actors use, and disclose their use of, VCM carbon credits is one area in which IOSCO can have a significant impact. There are currently numerous regulatory efforts ongoing to define the criteria for corporate disclosures of climate-related financial risks, which, in some cases, include the use of VCM carbon credits to mitigate risk and achieve sustainability claims.

There are also ongoing third-party efforts to establish definitions and best practices that can help improve the trust and transparency of the VCM. IOSCO can and should use its convening power to help bring these efforts together to drive further collaboration and harmonization among financial regulators around net zero corporate disclosure classification systems and carbon accounting principles.

Such dialogues should encourage development of “net zero” corporate disclosure principles modelled and build upon other historical efforts (e.g., International Financial Reporting Standards). The Securities and Exchange Commission in the United States and the European Financial Reporting Advisory Group in the European Union—have already proposed frameworks for corporate disclosures, which may include information regarding VCM and carbon accounting methodologies.

IOSCO should continue to work with these and other global financial regulators to set thresholds, or recommend best practices, related to the integration of corporate financial reporting with disclosures on climate-related transition plans, GHG inventories, and carbon offsetting. In particular, IOSCO should work to develop guidance on (a) corporate disclosure of the type and quality of VCM carbon credit asset portfolios as an important element of corporate accountability; (b) the degree of assurance regulators need from companies with respect to environmental claims management; and (c) the appropriate frameworks in which public companies should disclose their emissions and climate-related supply chain data.

Harmonization efforts could better align use of high-quality carbon offsets with corporate risk management, and do so by building upon existing independent standards and best practices promulgated by, e.g., the Task Force on Climate-Related Financial Disclosures, the Sustainability Accounting Standards Board, and the International Sustainability Standards Board (“ISSB”).[14]

Xpansiv respectfully submits these comments for consideration and thanks IOSCO for the opportunity. Please direct all follow up questions and inquiries to policy@xpansiv.com.

Yours sincerely,

/s/ John Melby

Chief Executive Officer

[1] International Organization of Securities Commissions, Voluntary Carbon Markets Discussion Paper, CR/06/22 (November 2022), available at www.iosco.org.

[2] https://xpansiv.com/cme-group-announces-first-trades-of-geo-futures/

[3] Xpansiv Ltd. represents a family of entities including CBL Markets (USA), LLC, CBL Markets Australia Pty Ltd., APX, Inc., Evolution Markets Inc., and Xpansiv Data Systems, Inc.

[4] 84% of the voluntary carbon offsets issued in 2022 were managed on Xpansiv’s registry infrastructure.

[5] 7 U.S.C. § 1a(9).

[6] Further Definition of “Swap,” “Security-Based Swap,” and “Security-Based Swap Agreement”; Mixed Swaps; Security-Based Swap Agreement Recordkeeping, 77 Fed. Reg. 48208, 48256 (Aug. 13, 2012) (“Products Release”).

[7] Products Release at 48232.

[8] Products Release at 48233; see, also, Matthew F. Kluchenek, The Status of Environmental Commodities Under the Commodity Exchange Act, Harvard Business Law Review Online, 39 (2015). (In discussing environmental commodities in a joint final rule defining certain terms in the Dodd-Frank Act, the CFTC noted that it: “understands that market participants often engage in environmental commodity transactions in order to transfer ownership of the environmental commodity (and not solely price risk), so that the buyer can consume the commodity in order to comply with the terms of mandatory or voluntary environmental programs. Those two features—ownership transfer and consumption—distinguish such environmental commodity transactions from other types of intangible commodity transactions that cannot be delivered, such as temperatures and interest rates. The ownership transfer and consumption features render such environmental commodity transactions similar to tangible commodity transactions that clearly can be delivered, such as wheat and gold. As a result, the CFTC found that ‘environmental commodities can be nonfinancial commodities that can be delivered through electronic settlement or contractual attestation.’”)

[9] Products Release at 48234. (The settlement method for environmental commodities is “equivalent to that of physical commodities where ownership is transferred by delivering a warehouse receipt from the seller to the buyer, thereby indicating the presence in the warehouse of the contracted for commodity volume.” Furthermore, “it is possible to manipulate the deliverable supply of an environmental commodity just as it is for a tangible commodity.”)

[10] Id. (“Therefore, an agreement, contract or transaction in an environmental commodity may qualify for the forward exclusion from the swap definition if the transaction is intended to be physically settled.”)

[11] See, CBL Standard Instruments Program.

[12] Exhibits 4, 5 & 6 show the increasing utilization of these spot contracts and the market-driven price differentiation between standard contract types.

[13]See, Press Release (November 18, 2021).

[14] For example, the ISSB Exposure Draft for Climate-related Disclosures “was developed in response to calls from users of general purpose financial reporting for more consistent, complete, comparable and verifiable information, including consistent metrics and standardized qualitative disclosures, to help them assess how climate-related matters and the associated risks and opportunities affect [their performance and strategy].” International Sustainability Standards Board, Exposure Draft ED/2022/S2, Climate-related Disclosures (March 2022).