2022 VCM Review

XPANSIV CARBON MARKET REVIEW:

Trading Insights from 2022

2022 VCM Summary

2022 was a turbulent year for global financial and commodity markets. The voluntary carbon market (VCM) was no exception. The Russian invasion of Ukraine and broader macroeconomic conditions drove many VCM market participants to pursue risk-off strategies, slowing CBL trading volume by 32% year-over-year in the second half of 2022. VCM-specific metrics also saw a decline, with issuances down 6% on prior year, while the pace of retirement increases slowed to 2% annual growth amid increased publicity around carbon credit integrity (Trove Research).

Despite the negative macro trends, the VCM proved to be resilient, and it continued to evolve in terms of market structure development. Trading of spot standardized contracts increased by 97% volumetrically providing price clarity and liquidity that were previously unavailable. CME Group’s CBL emissions futures volume jumped 345% reflecting strong market adoption of the contracts to manage price risk efficiently within a regulated contract market. Basis markets linked to standardized contracts emerged, providing additional price signals for bespoke segments of the market.

In this report, we will examine some of the major trends of the past year via data generated from Xpansiv’s spot market, CBL, to provide a clear picture of the evolution and maturation of the VCM.

Prevailing Indicators of Long-Term Growth Amid Short-Term Hesitation

All told, the market grew in 2022 even through patches of low trading activity. The value of credits traded on CBL increased by 44% to over $795 million USD, while volume traded totaled 116 million tons, just 6% below 2021’s record total.

The number of firms transacting in CBL’s spot market rose to nearly 200 firms, up 32% from 2021.

Additional growth occurred in derivatives markets as volume traded among the CBL GEO futures contracts listed by CME Group exceeded 209 million credits and average daily volume rose by 281% to 835 contracts (equivalent to 835,000 credits). Open interest* on the contracts also grew throughout 2022, peaking above 29 million tons in December.

*Open interest reflects the number of open positions in a futures contract. For more information read CME Group’s explainer found here.

Increasing Usage of Standardized Contracts and Basis Trading

Usage of standardized spot market contracts saw significant growth in 2022. Volume traded through spot GEO contracts on CBL increased by 97% from 2021 levels, up to 32.3 million tons. The portion of total CBL volume traded through standardized contracts increased as well, peaking at 38% of spot volume in Q3 2022.

Standardized contracts provided the market with clear price signals throughout the turbulence of 2022, allowing market participants to quickly evaluate specific market segments.

Among the standardized contracts, the N-GEO emerged as the most prominent VCM benchmark. N-GEO volume accounted for 31.5% of CBL spot contract volume, and over 68% of futures volume.

Emergence of Basis Trading

Another trend that emerged in 2022 was the trading of credits at basis to standardized instruments. Market participants began to use the N-GEO as a tool to price project-specific credits with additional attributes that would achieve a premium price compared to the N-GEO. By midyear, there were virtually no transactions of N-GEO eligible credits settling via CBL at a discount to the spot N-GEO price. The underlying contract effectively set a baseline price for eligible credits, and participants could then value the basis differential of project-specific credits based on additional attributes.

While many attributes can affect the premium that eligible credits earn relative to the baseline, the most significant driver was vintage. While the average basis of all N-GEO eligible credits on CBL rose to $8.34 in Q4, 2016 and 2017 credits achieved lower premiums to the N-GEO versus more recent credits. 2016 credits on average traded at a $2.63 premium to the spot N-GEO price in Q4, while 2017 credits achieved $2.90. The 2018 vintage average basis in Q4 was slightly below the average for all N-GEO eligible credits at $8.03, while the 2019, 2020, and 2021 vintage averages were $12.69, $11.79, and $13.56 respectively.

While some N-GEO eligible credits may trade at significant differentials to the spot N-GEO price, market participants still utilize the contract and forward curve as a reference price. Basis trading at differentials to standardized contracts delivers price transparency and expanded flexibility to project-specific credit transactions, which last year comprised 70% of CBL volume.

Basis markets are a hallmark characteristic of developed commodity markets, and the emergence of basis trading in the VCM is indicative of the progress the market has made in recent years. The combination of liquid spot benchmarks and basis markets structured on top of standardized contracts has introduced clear and transparent pricing stratification into the VCM, as displayed in the graph below. Standardized contracts act as a price floor for qualifying credits which trade at varying premia to the relevant contract. Participants also have the option to trade non-qualifying credits at discounts to standardized contracts.

As the VCM continues to evolve and market sentiment on quality and other credit attributes shift, standardized contracts will continue to produce price signals for the baseline qualification criteria. If other widely accepted indicators of value emerge, we will consider them as qualification criteria for future standardized contracts.

Developing Demand for High-Quality Offsets and New Indicators of Quality

Market participants demonstrated an increasing appetite for high quality credits in 2022 as public attention toward credit integrity increased. Xpansiv consultation with market participants on the quest for high quality credits resulted in the launch of the Sustainable Development Global Emissions Offset (SD-GEO) contract which accepts delivery of credits from clean cookstove projects with five or more verified SDG contributions.

Since launch, the SD-GEO has traded at significant premiums to other standardized contracts, delivering price clarity to the growing cookstove market segment. Trading began in the $10.50 range and finished the year at $9.80.

Market liquidity for removals credits also picked up as the first blue carbon issuances became available, achieving record high prices on CBL above the $30 mark.

2022 Trends by Region and Project Type

Additional trends in the market are identifiable in transactions of project specific credits on CBL which totaled 74.7 million tons last year. Xpansiv makes the granular data generated from these transactions available as a subscription service.

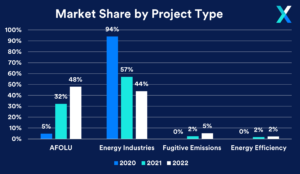

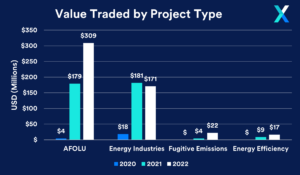

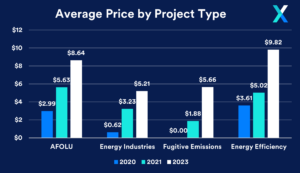

To start, the nature-based segment of the market continued to pick up market share as AFOLU credits became the most popular type of credit traded in 2022, eclipsing energy industry credits. The nature-based market share reached 48% of volume as value traded exceeded $309 million, up 72% from 2021. The average price of nature-based credits rose to $8.64 in 2022, making them the highest priced offsets with the exception of niche energy efficiency credits that averaged $9.82 per credit.

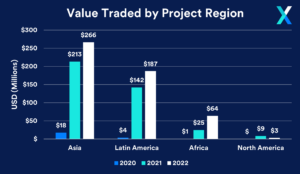

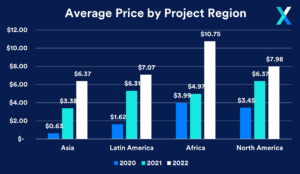

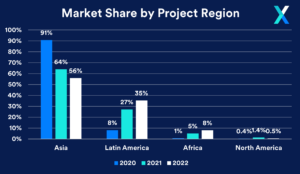

The share of traded credits generated from projects located in Asia decreased in 2022, falling to 56% of CBL’s project-specific market. This was largely due to the fall in trading of Asian energy industry credits, which fell volumetrically by 42% in 2022, and the sustained popularity of Latin American nature-based credits whose market share rose to 32%, up from 22%, in 2021.

Notably, the African segment of the market saw significant growth in 2022 jumping to 8% of the market by volume with over $63.6 million in value traded. While trading in cookstoves picked up with the launch of the SD-GEO, African market growth was primarily driven by trading of nature-based credits which jumped by 164% to 3.9 million tons. Finally, the average price of credits from Africa was highest among all regions at $10.75 per credit.