Xpansiv Quarterly VCM Review – Q2 2023

Q2 OVERVIEW

Consolidation in the voluntary carbon market slowed through the second quarter of 2023. CBL volumes held steady from Q1 levels, totaling 9,032,821 tons. As in Q1, demand largely reflected purchases from stalwart corporate market participants buying credits to fulfill established sustainability and net-zero programs.

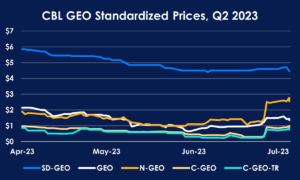

Prices in the nature and CORSIA market sectors recovered markedly after falling for most of the quarter to set new lows in early June. The CORSIA-aligned GEO and the N-GEO nature bellwether rallied 79% and 45% respectively off their lows by quarter-end. This rally has extended into the early days of Q3, powered by the endorsement of CORSIA credits by the VCMI, and the N-GEO’s first-ever vintage roll to a range of 2018-2023 on 1 July. As of 12 July, the GEO settled at $1.45 up 123% off its June low. The N-GEO settled at $2.77, up 177% from its June nadir.

The vintage roll reset the C-GEO broad-based tech indicator price to $0.99, up more than 230%, and the cookstove sector SD-GEO reference up 1% to $4.45.

STANDARDIZED CONTRACT PRICES – Q2 2023

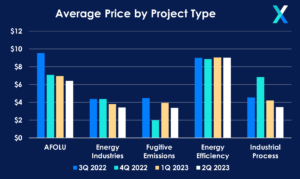

During Q2, prices for the C-GEO, which tracks a broad basket of technology credits, fell 66% to close at $0.34. CORSIA-aligned credits measured by the GEO contract fell 42%, to $1.25. The nature-sector’s N-GEO bellwether lost 29%, ending at $1.45 and the cookstove SD-GEO indicator, shed 22%, closing at $4.60.

CORSIA PHASE 1 ELIGIBILITY DRIVES ACR CREDIT VOLUME

Trading of American Carbon Registry (ACR) credits rose to a record high in Q2 after ICAO announced that vintage 2021-2026 ACR credits would be eligible for the upcoming CORSIA Phase 1, which runs from 2024-2026.

Total ACR volume topped 1.8 million credits, 91% of which meet the announced CORSIA Phase 1 eligibility criteria.

The Q2 volume weighted-average price of these Phase 1-eligible credits was $3.57, compared to the on-screen average price of $1.17 for GEO credits which are eligible for the current 2021-2023 Pilot Phase.

Q2 STATISTICAL REVIEW

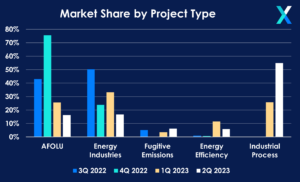

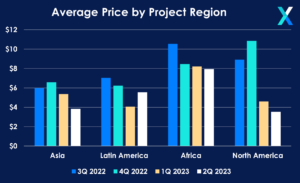

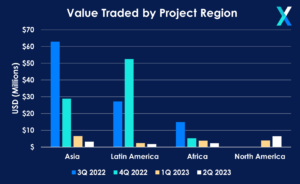

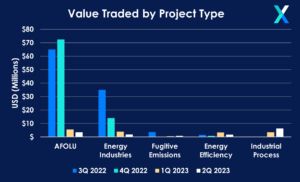

The most notable shifts in the flows of transactions by regional and project type were related to CORSIA compliance Phase 1 activity in the market. North American credits rose to 56% of volume traded, up from 0.5% in all of 2022. The shift was driven in large part by transactions of North American industrial process credits from the American Carbon Registry.

As a result, the share of credits traded from industrial process projects also rose sharply, hitting 55% of all volume, compared to 36% in Q1 and less than one percent in all of 2022.

The shift to North American industrial process credits marks a significant departure from the patterns established during the remarkable growth phase the voluntary carbon markets witnessed from 2020-2022, where increases in trading volumes were driven by nature-based projects from around the globe, particularly Latin America.