Xpansiv Acquires OTX, Expands into U.K., Europe

Xpansiv Acquires OTX, Expands into U.K., Europe

LONDON, MILAN, SYDNEY, NEW YORK – March 22, 2021 — Xpansiv CBL Holding Group Limited (Xpansiv), the global market for Intelligent Commodities™, today announced that it has acquired Project OTX Limited (OTX), making it a wholly-owned subsidiary of Xpansiv.

Founded in 2013 by Francesco Dolci and Amedeo Giammattei and incubated by AitherCO2, OTX is a leading market-access provider for Compulsory Stockholding Obligations (CSO), rapidly expanding into renewable fuels and renewable fuel certificates. With operations in London and Milan, OTX provides voice and electronic market access to more than 200 customers in 27 countries. In 2014, OTX developed and launched the first electronic platform for the exchange of CSO tickets.

The acquisition marks Xpansiv’s formal entry into the U.K. and Europe, both at the forefront of ESG and market innovation. The companies’ customer bases are complementary—seeking solutions in the energy transition—and will benefit from access to an ESG-centric platform that will incorporate conventional and bio-based fuels.

“This is an exciting new chapter for Xpansiv as we get ready to enter the global fuels market,” said Xpansiv Chief Strategy Officer Nathan Rockliff. “There are multiple synergies between OTX and Xpansiv—we’re expanding the potential of both companies.”

“OTX will provide new opportunities across the Xpansiv platform,” said Xpansiv CEO Joe Madden. “CBL products like the Global Emissions Offset™ and the recently announced N-GEO™ help address immediate ESG exposure, while OTX can expand the application of Digital Feedstock™ to underlying fuels.”

“We’re delighted to join Xpansiv,” said OTX co-founder Francesco Dolci. “We look forward to expanding the range of products offered to our customers. The potential for cross-selling is extraordinary.”

“Now we can better support our customers with the greatest exposure to climate risk—refiners, oil majors, cement companies—in achieving their climate impact reduction goals,” added OTX co-founder and Managing Director Amedeo Giammattei.

Xpansiv and OTX have a long history together. “OTX’s innovative culture—combined with their core competency in markets, physical commodities, and ESG—is unique and directly aligned with our approach to the energy transition,” said Xpansiv President and COO John Melby. “We’re confident that together we’ll accelerate the convergence of ESG and conventional commodities.”

This transaction, on which Gestio Capital acted as financial sponsor to OTX, marks another milestone on Xpansiv’s strategic-acquisition path to advance its market position, expand into new geographies, and accelerate its growth in global commodity products. It follows the acquisition of Venus in 2020 and the Environmental Management Account platform from APX, Inc. in 2019.

About Xpansiv

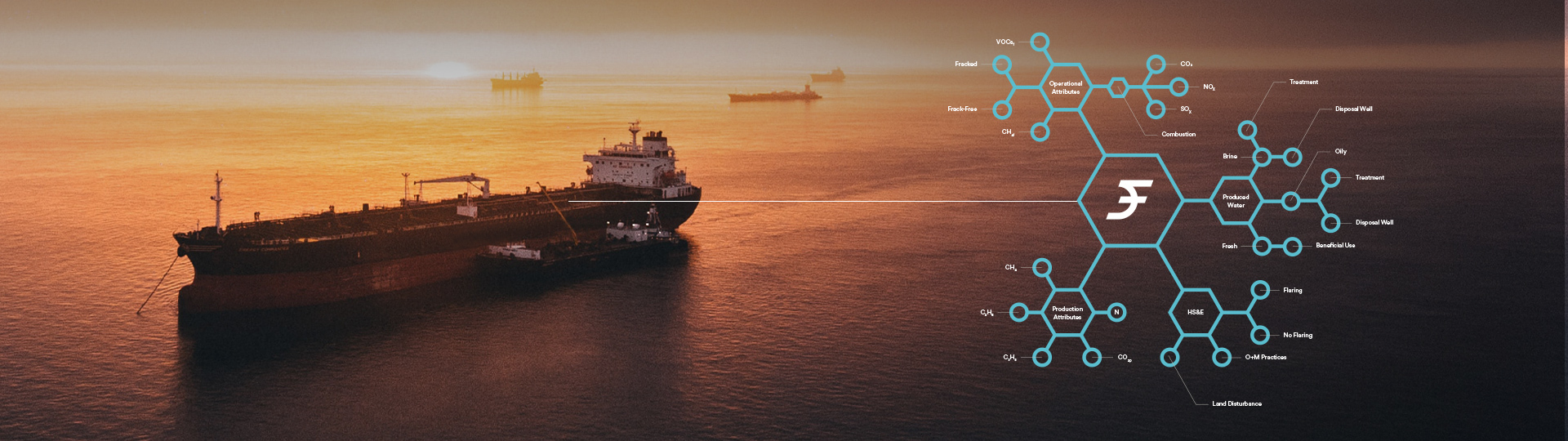

Xpansiv is the global market for ESG-inclusive commodities. These Intelligent Commodities bring transparency and liquidity to markets, empowering participants to value energy, carbon, and water to meet the challenges of an information-rich, resource-constrained world. The company’s main business units include CBL, the leading spot exchange for ESG commodities, including carbon, renewable energy certificates, and Digital Natural Gas™; H2OX, the leading spot exchange for water in Australia; and XSignals, which provides end-of-day and historical market data. Xpansiv is the digital nexus where ESG and price signals merge. Xpansiv.com

About OTX

Founded in 2013 as the first company to introduce electronic brokerage in the market for compulsory stockholding obligations (CSO), OTX is now one of the leading market-access providers in the CSO space. Today, OTX provides voice and electronic market access to hundreds of customers in 27 countries and has established a solid dialogue with competent authorities across Europe. The company is rapidly expanding into other illiquid commodities markets, including renewable fuels and renewable fuel certificates. OTXGroup.com

About AItherCO2

Founded in 2010, AitherCO2 is a leading provider of financial services to the world’s environmental and energy markets offering consultancy and trading solutions to companies subject to regulatory obligations, as well as those operating voluntarily in the environmental markets. We provide market access for industrial, aviation, and shipping clients both on the regulated exchanges as well as through our vast counterparty network. With offices in Milan, Lugano, London, Barcelona, Athens, Dakar, and San Francisco, we are able to cover our 2000 clients’ needs wherever they are. AitherCO2.com

About Gestio Capital

Gestio Capital is a London based multifamily office focused on offering wealth management and family office services to high-net-worth individuals, their families, and their businesses. The company’s mission is to look after the business of private investors by overseeing, growing, and securing their financial interests.

US Contact: Rob Dalton, Xpansiv VP Communications—rdalton@xpansiv.com

AU Contact: Michael Mullane, Xpansiv PR Contact—michael.mullane@edelman.com