The Premier Destination for Environmental Market Data

Xpansiv market data and analytics enable market participants to measure, model, and weigh risks and opportunities with greater confidence and clarity.

Comprised of firm bid/offer and transaction details, Xpansiv data covers hundreds of project-specific credits as well as GEO® standardized contracts traded on Xpansiv market CBL—the leading spot exchange in environmental markets.

Neutral, multicontributor exchange data is more robust than pricing from opaque, fragmented legacy sources. This data generates more accurate, reliable signals in trading, valuation, and risk models.

One Suite of Benchmarks Priced by Three Market Leaders

Xpansiv data is the highest quality available in the voluntary carbon market. Our database spans a vast range of transactions, covering 500+ project-specific trades back to January 2019, as well as every trade in CBL’s GEO benchmark suite since inception.

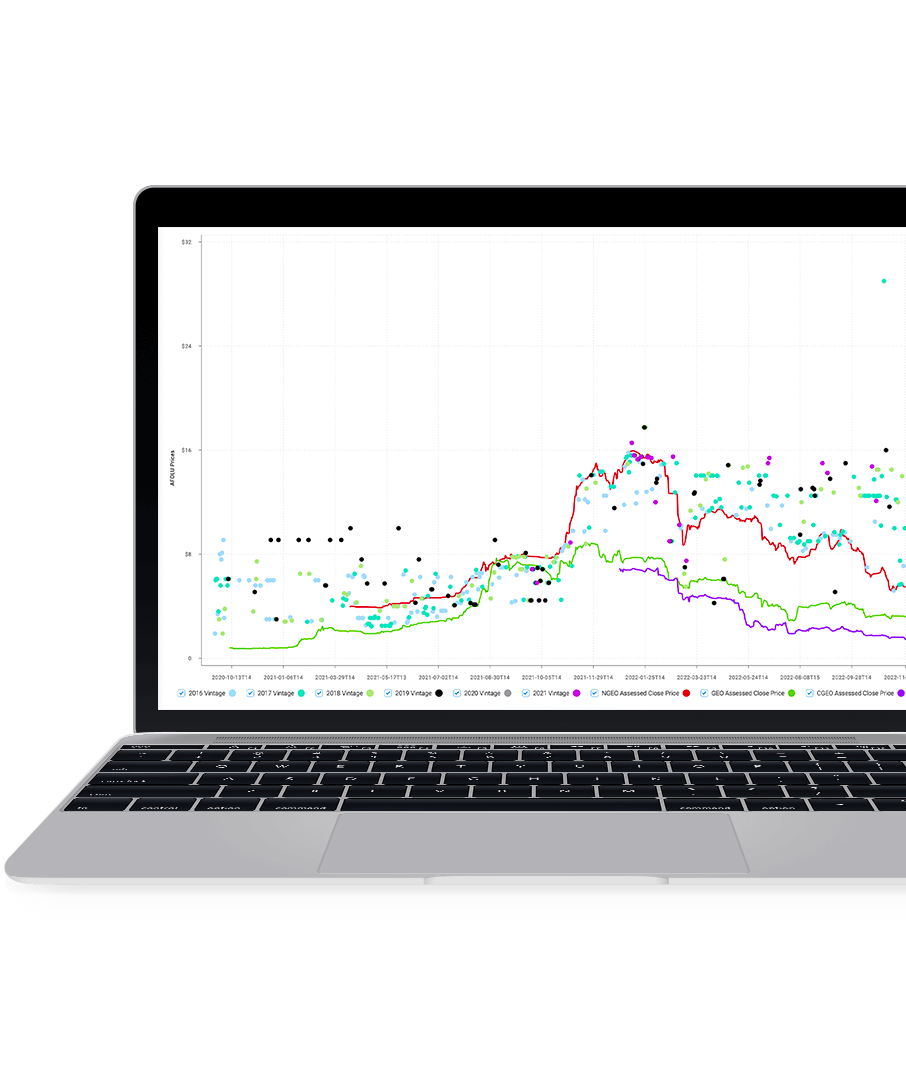

Our analytics dashboard synthesizes thousands of CBL transactions into intuitive, interactive graphics. Daily trade reports provide detailed data on exchange-matched and OTC-cleared transactions, keeping subscribers up to date on the latest VCM movements.

Xpansiv’s daily and historical data is ideally suited to back-, middle-, and front-office uses. It is available via a web portal, APIs, and daily emails.

Multiple Registry Data from a Single Access Point

Xpansiv provides a single source of aggregated issuance and retirement data from the ACR, Climate Action Reserve, Gold Standard, and Verra Registry. This streamlined access enables users to quickly analyze supply and demand across project type, country, eligibilities, and other relevant metrics, eliminating the need to log into each registry to manually record and aggregate data, saving considerable time and resources.

Better Data, Better Results

Xpansiv’s neutral, independent, multicontributor project and benchmark data is the most robust available. It drives superior results for all market stakeholders, including:

- Corporate sustainability managers

- Project developers

- Traders

- Market analysts

- Risk managers

- Portfolio managers

- Capital markets professionals

- Brokers

Please contact us to find out more about Xpansiv’s platform and services. We look forward to speaking with you!

Contact Us